Itaú (case study)

Desktop and mobile web smart tv

Screen redesign project on financial education for Itaú bank.

This project is an independent initiative aimed at addressing issues identified in digital products. It is not affiliated with any company or brand. The proposed solution is based on studies and publicly available content related to the topic.

Desk research

The desk research began by identifying common problems and signs of resistance among bank users in Brazil. It is important to consider that banks are often among the institutions that receive the highest number of customer complaints. Therefore, applying an appropriate filter to this information is essential to ensure that any proposed digital product offers a real solution to the highlighted issue.

One of the key findings came from a survey conducted by QualiBest in July 2022 with 1,831 participants. It revealed that only 32% of people invest in financial products other than savings accounts, despite savings being one of the lowest-yielding fixed income options when compared to alternatives like CDBs, LCIs, LCAs, and government bonds. The same study also showed that 35% of respondents do not invest at all, and among those who do, most are men from the AB social class.

Furthermore, according to the Credit Guarantee Fund (FGC), as of early 2021, there were 235 million active savings accounts in Brazil — a number that highlights how a large portion of the population remains unaware of more profitable investment alternatives.

A separate survey by SPC Brasil (Credit Protection Service) in 2020 found that around 45% of Brazilians do not manage their personal finances, and of those who do, more than 20% rely solely on memory to track expenses. Additionally, data from the Central Bank (September 2022) indicated a worsening situation: over the previous 12 months, credit granted by financial institutions increased by 18.2%, signaling growing indebtedness among Brazilians.

The research further revealed that non-essential expenses are often deprioritized compared to basic needs. For example, the majority of respondents said they record monthly expenses related to supermarkets and utility bills (93.5%) and income (90.1%). However, only 39.5% track discretionary spending such as leisure, dining out, personal care, clothing, and accessories on a weekly basis.

“The research shows that many of those who claim to systematically control their spending actually do so far less frequently than needed,” explains Marcela Kawauti, Chief Economist at SPC Brasil.

Among those who use some form of organization to manage finances (53.9% of respondents), the most common method is a notebook (29.8%), followed by spreadsheets (21.0%), and digital applications (just 3.1%).

Another study conducted in early 2024 by Instituto Locomotiva in partnership with Xpeed (XP Inc.’s financial education platform) revealed that 47% of respondents started making long-term plans due to the economic crisis, and 90% recognized the need for financial education. According to the same study, 63% stated they had only basic knowledge of personal finance.

This was the case of Mariana Ortiz, a psychologist who sought help to plan for her retirement while working as a freelancer:

“I decided to look for financial consulting because I had some long-term plans, like retirement. I was trying to manage everything on my own, but I felt lost. I wanted to make sure I was on the right track, especially since I’m still new to this topic and felt insecure.”

The same sentiment was echoed by Daniele Antunes, a photographer who initially viewed financial planning as overly complex and full of technical jargon. However, her experience with consulting changed her perception:

“Financial consulting gave me a broader view of my income and helped me plan for the long term. Before that, my finances were a mess, mixing personal and business expenses.”

This research clearly shows that the main barriers to financial control in Brazil are a lack of financial education and poor planning habits. Despite the availability of digital tools, low awareness, limited access, and trust issues continue to hinder the adoption of effective financial management practices. Addressing these challenges through accessible, trustworthy, and user-friendly digital products — possibly backed by established institutions — is a key opportunity for innovation.

CSD

To structure our research and problem-solving approach, we will use the CSD Matrix — a framework that categorizes Certainties, Suppositions, and Doubts. Each element will be validated through objective and data-supported insights.

Benchmark

In a brief research, several well-designed digital solutions were identified that bring together key characteristics of a good product aimed at solving a common issue faced by the population: the lack of financial organization.

Some of the platforms found include Mobills, My Money, Organizze, among others.

All of these platforms offer automated integration with bank accounts and credit cards, and feature user-friendly, well-structured interfaces. Any of them could serve as a solid option for managing personal expenses and investments.

However, certain drawbacks were identified:

All of these solutions are paid services and are developed by relatively unknown organizations. This makes it harder to gain user trust, especially when it comes to sharing sensitive financial data with unfamiliar companies — and paying to do so.

On the other hand, if a similar platform were offered free of charge by a well-established bank like Itaú, this objection could be addressed. From the perspective of this research, such an initiative would provide a more effective and trustworthy solution to the problem.

Given this, it makes sense to shift focus to another important aspect analyzed here: financial education — and how institutions can help reduce barriers to access for the average Brazilian user by offering content in a clear, fair, unbiased, and reliable way.

First, let’s define what financial education is.

According to the Organization for Economic Cooperation and Development (OECD), financial education is “the process by which individuals improve their understanding of financial products and services, empowering them to make informed decisions.”

In simpler terms, financial education is the ability to understand how money works.

It’s important to highlight that all platforms analyzed here lack basic financial education resources, which are essential for every citizen.

Based on this, we identified a list of initiatives led by Brazilian banks and institutions that aim to provide their users with quality educational content.

Itaú

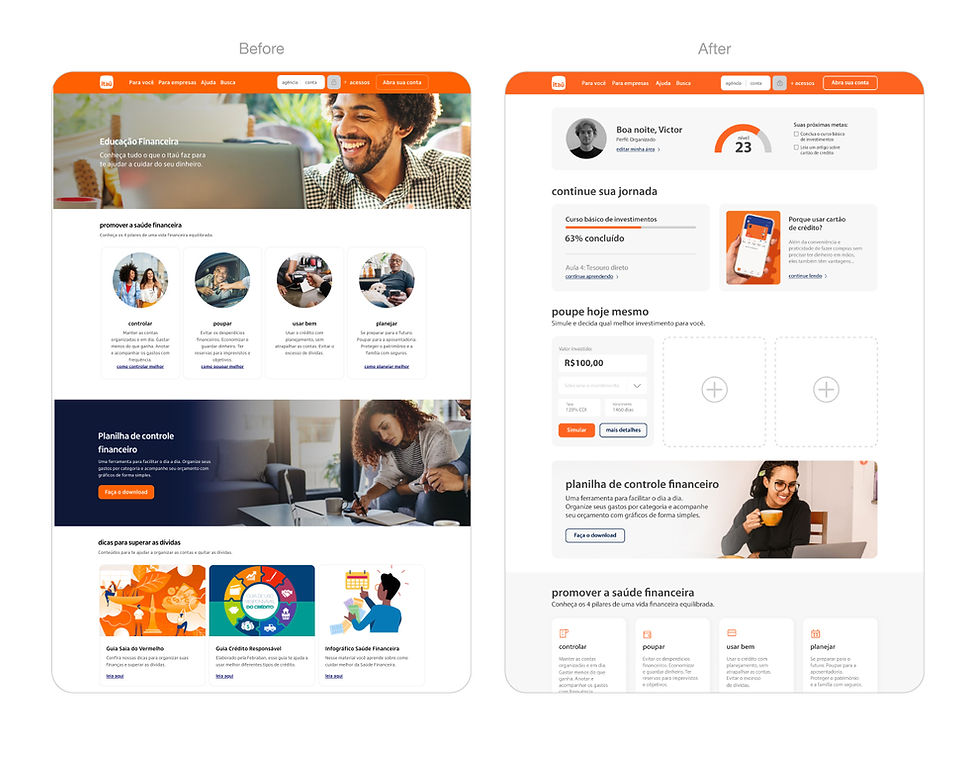

Itaú offers a simple landing page focused on financial education, featuring segmented content, explanatory videos, and supporting materials such as downloadable spreadsheets and blog articles.

The site provides a substantial amount of proprietary content, as well as external links to resources like Inteligência Financeira — a news platform supported by Itaú — and Meu Bolso em Dia, a free platform from Febraban focused on promoting healthy financial habits.

However, most of the links on the page redirect users to external PDFs without prior notice, which may affect user experience and accessibility.

Bradesco

Bradesco offers two platforms related to financial education.

The first is a content portal focused on timely topics, featuring blog posts, news articles with external links, and expert commentary on a variety of financial subjects.

The second is a project by Fundação Bradesco — the Escola Virtual (Virtual School) — which provides a free, beginner-level financial education course with an estimated duration of 4 hours, open to the general public.

bradesco/html/classic/novo-educacao-financeira

Banco do Brasil

Banco do Brasil features educational content on its blog, including articles related to personal finance.

One of these articles provides access to eBooks and courses offered through the Brazilian Government’s initiative, the Virtual School for Personal Finance Management (Escola Virtual de Gestão de Finanças Pessoais).

bb.com.br/site/pra-voce/solucoes-digitais/minhas-financas

blog.bb.com.br/educacao-financeira-conheca-cursos-gratuitos/

Santander

Santander provides a dedicated landing page focused on financial education.

The page features blog articles, external news pieces, and curated content aimed at helping users improve their financial literacy. It also offers direct access to Meu Bolso em Dia,

a free platform developed by Febraban, which promotes responsible money management and financial well-being.

Nubank

Nubank offers a blog dedicated to financial education, featuring a variety of practical articles designed to help its customers manage their finances more effectively.

In addition, the bank launched an educational video platform within its native app called NuEnsina. This product included video lessons, and users who completed the full course received a certificate issued by B3, the Brazilian Stock Exchange.

However, by the end of this research, the NuEnsina platform was no longer accessible, and no current content could be found.

It appears that some users noticed its disappearance. For example, Suzana Souza, in the NuCommunity portal, posted:

“Hi everyone, how are you? I’ve been studying with NuEnsina every day at the same time, but when I tried to access it earlier today, I couldn’t find it. Does anyone know if it was removed?”

blog.nubank.com.br/tag/educacao-financeira/

C6 Bank

C6 Bank’s financial education initiative goes beyond the digital environment.

In addition to an online blog featuring articles on a variety of topics, the bank also runs the “Expedição Financeira”(Financial Expedition) program — a social impact project led by the bank’s internal team.

As part of this initiative, the team travels across Brazil to deliver in-person workshops, lectures, financial clinics, and personalized consultations, tailored to each participant’s specific needs and goals.

The content from these sessions is recorded and shared on the bank’s social media channels, such as this video on YouTube.

c6bank.com.br/blog/expedicao-financeira-conheca-o-projeto-educacional-do-c6-bank-com-o-sas-brasil

Next

Next Bank launched a financial education web series titled Curta sua Grana, hosted by financial mentor and content creator Cecília Assis.

The series consists of four episodes, available on YouTube, and offers practical guidance on managing personal finances.

In November 2021, Next partnered with Zumbi dos Palmares University to co-create content aimed at encouraging young people to develop better financial control and planning habits.

So far, the bank’s online financial education efforts are limited to this project.

Febraban

Febraban’s financial education platform shows strong potential, offering a highly comprehensive and user-focused experience.

The journey begins with a brief registration process that includes a set of questions designed to assess the user’s financial profile. Once all questions are answered, the platform provides an analytical overview of the user’s financial behavior.

Based on the results, the user is redirected to a personalized homepage tailored to their preferences and needs. From there, they can explore a wide range of educational content, including quizzes, video lessons, courses, and articles.

The platform also offers interactive tools to help users plan and manage their finances more effectively. To enhance engagement, it features a gamification system with missions and a points-based reward structure.

Conclusion

It is clear that all institutions recognize the importance of addressing financial education. However, some invest more time and resources into the topic than others. This research revealed a variety of approaches to tackling the same problem — including blogs with written articles, explanatory video series, complete online courses, in-person initiatives, and intelligent learning systems.

Despite the presence of educational content across all institutions, it is evident that, in general, banks do not dedicate significant effort to this area. In most cases, the topic is addressed superficially, often through generic products and lengthy text-based content that may not fully engage or support users.

Among the initiatives studied, Febraban (Brazilian Federation of Banks) stood out as the most committed to promoting financial education. As a non-profit association and the main representative of the Brazilian banking sector, Febraban’s mission includes contributing to the country’s economic, social, and sustainable development. In this context, it developed a robust platform with rich, user-focused content — a resource that deserves broader awareness and accessibility for all.

User Research

With the project moving into the field stage, it became necessary to validate the findings from the desk research and benchmark analysis with real users. This data serves as a foundation for the development and decision-making process of the project.

Survey: A questionnaire with 17 questions was created using Google Forms.

The survey was conducted between April 15 and April 16, 2024, and received responses from 32 participants.

Personas

Conclusion & Insights

The demographic sample for this survey showed that 81% of respondents live in the Southeast region of Brazil. Age distribution was divided into four groups, with the majority (43%) aged between 26 and 33. Regarding education level, most respondents reported having completed higher education, with only 6% lacking a college degree.

The most commonly used banks among participants were Itaú (59%), Nubank (56%), and Bradesco (25%). The most valued factor when choosing a bank was the quality of its digital product, selected by 81% of respondents.

Most participants said they learned the basics of personal finance on their own, using online content (56%). However, some data points stand out:

Only 6% learned about the topic at school, and none selected the option “My bank helped me when I opened my account.”

This suggests that while people are interested in learning, they do not see banks as a source of financial education, even though they are customers.

A section of the survey tested respondents’ financial knowledge, with questions every citizen should ideally be able to answer. When asked about the meaning of the acronym CDI (Interbank Deposit Certificates), 68% answered correctly, while 25% said they didn’t know and 6% answered incorrectly.

On the other hand, when asked which index measures the price of average consumer goods in Brazil (IPCA), only 40% answered correctly, and 60% didn’t know the answer.

These two questions alone reflect a concerning scenario: even among respondents with higher education, there is a lack of basic understanding of how inflation affects daily life.

More than half of the participants rated themselves as having intermediate to advanced knowledge of financial topics. Yet, 46% admitted to being at a basic level, stating that they do not know where or how to invest their money properly.

31% said they are in debt (excluding installment purchases).

Only 12% file their income tax independently, while 18% do it themselves with the help of online content. Still, 67% rely on someone else to handle it for them — paid or not.

When asked which topics they would most like to learn about in a financial education platform (respondents could choose up to two options), the top responses were:

-

“The best investment for my profile” – 62%

-

“How to use credit cards to my advantage” – 46%

-

“Interest rates and inflation” – 34%

56% of respondents said they would access a financial education platform if it were provided by their bank.

As for preferred content format, 40% preferred short videos, while 34% preferred varied content tailored to their personal profile.

Additional responses reveal that even among individuals with higher education, there is a significant need for more accessible financial education. Many rated themselves at a basic level, lacking financial autonomy. At the same time, most said they would be willing to engage with this content if it were dynamic and personalized.

Since most participants value the digital experience when choosing a bank, usability should be a priority.

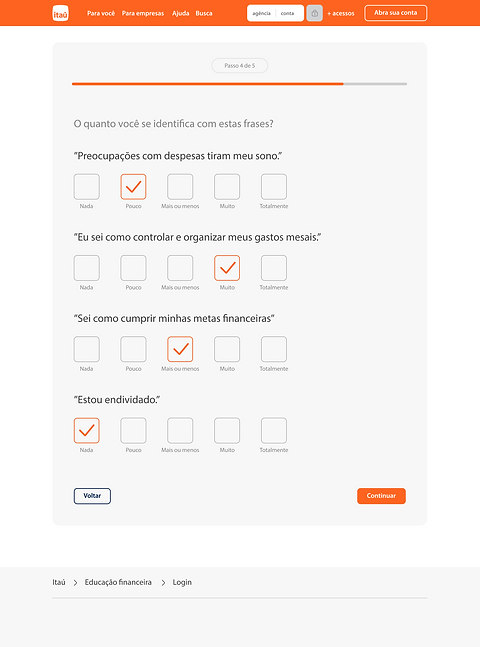

It is entirely feasible to address sensitive and relevant topics based on individual profiles — for example, through dynamic tests that assess users’ financial knowledge and redirect them to personalized learning paths.

The content should cater to a broad audience, from new users to elderly clients, and cover fundamental topics such as interest rates, inflation, investment options, and basic economics.

MoSCoW

User Journey In-App

UI Design

Wireframe

Initial Screen

The initial screen is the user’s first point of contact. It must be clear and straightforward about its purpose — providing only the essential information so the user can decide what action to take.

Here, the user can:

-

Create a new account and proceed with the registration process

-

Log in with an existing account

-

Or continue to the default experience without a personalized journey

Step 01 and 02

Step 03 and 04

Step 05 and 06

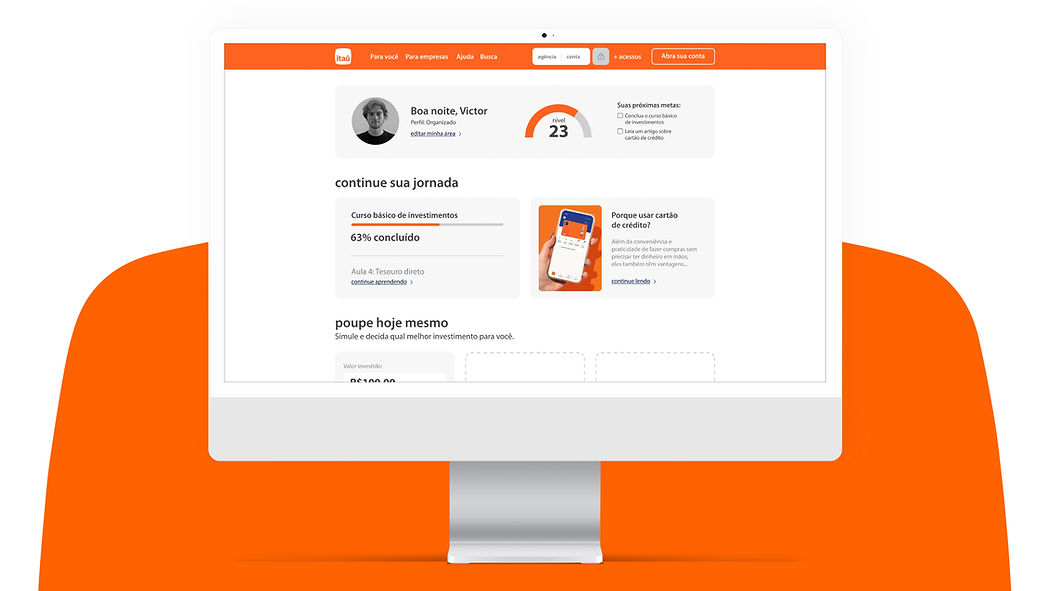

User Page

Gamification Dashboard

This section displays the user’s profile, progress, and ranking.

The system operates with gamification mechanics, rewarding users as they advance in their learning path.

Learning Journey Continuation Area

Based on the user’s profile, the most relevant learning path is suggested here, along with any incomplete stages that still need to be finished.

Investment Simulator

A hands-on area where users learn how and where to invest.

They can compare up to three investment options simultaneously and decide which one best fits their goals — encouraging independence and showing that investing doesn’t have to be complicated.

Downloadable Resources Banner

Call-to-action for external content downloads, such as spreadsheets and tools to support daily financial planning.

The Four Pillars of Financial Health

These are the core principles every user should keep in mind.

Each card links to blog content that explains and illustrates the respective topic.

Personalized Video Content & Series

Dynamic and personalized video content based on the user’s navigation and interests.

Free Courses Banner

Promotional banner linking to free, open-format financial education courses, personalized per user.

Sensitive Topics Section

Dedicated space for critical financial topics like debt, delinquency, and recovery strategies, along with support resources.

Extra Content Section

Additional resources such as downloadable files, external links, and integrations with other platforms.

User Home Page

Generic Home Page

Others Devices